Warren Buffett’s Insight on Index Funds: A Cost-Effective Strategy for Investment Diversification

If there’s one thing I’ve learned from Warren Buffett, it’s that simplicity often trumps complexity when it comes to investing. The Oracle of Omaha himself has been a vocal advocate for index funds, and for good reason.

Index funds offer a straightforward, cost-effective way to diversify your portfolio. With just one purchase, you’re buying a small piece of hundreds or even thousands of companies. It’s no wonder Buffett advises most investors to opt for these “set it and forget it” funds.

Buffett’s endorsement of index funds isn’t just talk. He’s put his money where his mouth is, famously betting a million dollars that an S&P 500 index fund would outperform a collection of hedge funds over a 10-year period. Spoiler alert: he won. Let’s dive deeper into why Buffett is such a fan of index funds.

The Simplicity of Index Funds

When we hear Warren Buffet’s name, we can’t help but associate him with the success and simplicity of index fund investing. So, what’s the fuss about, and why does Buffet advocate for this means of squeezing the most out of the markets?

To put it in layman’s terms, index funds are a type of mutual fund with a portfolio constructed to match or track the components of a financial market index, such as the Standard & Poor’s 500 Index (S&P 500). They give investors broad market exposure, low managing fees, and low portfolio turnover. Essentially, it’s like choosing to ride on the overall wave of the market, rather than trying to pick individual winning stocks.

Let’s put this into perspective. When I enter into an index fund, I’m not dedicating my investment to one single company. Instead, I’m spreading my investment across a broad market, making it less susceptible to the rise and fall of individual companies. This type of investment strategy is called diversification, and it’s a key component in managing investment risk.

You might be asking yourself, “why wouldn’t I want to pick individual winners?” The reality is, despite our best judgments and research, picking individual stocks is an uncertain game. Statistically, many actively managed funds that aim to beat the market fail to do so. In fact, according to a report by S&P Dow Jones Indices, over a 10-year investment horizon, 85% of large-cap fund managers failed to outperform the S&P 500.

Let’s refer to an imaginary markdown table creation:

| Parameters | % of large-cap Fund Managers |

|---|---|

| Failed to Outperform S&P 500 over 10 years | 85% |

That’s not to say index fund investing is without risks. Market-wide downturns affect index funds just as they do individual stocks. But the main attraction with index funds is that they offer a straightforward, low-cost way to get a broadly diversified portfolio.

Hence, the “simplicity” in The Simplicity of Index Funds is achieved by balancing both the risks and rewards of the market, reducing an over-reliance on one particular stock’s performance. Buffet’s endorsement serves as a testament to the strength and sustained power of this investment strategy.

Cost-Effective Portfolio Diversification

Index funds aren’t just another investment vehicle; they’ve become the backbone of a smart diversification strategy. ETFs and mutual funds tracking market indexes like the S&P 500 have grown popular, thanks to Warren Buffett’s fervent endorsement. As someone who’s seen the financial markets inside and out for decades, his backing carries weight.

Why does a legend like Buffett stand behind index funds? It’s simple: index funds offer broad market exposure, thus making them an effective way to diversify your investments. Spread your money across the entire market, not just a select few stocks. This approach cushions the blow should a single company or sector take a downturn.

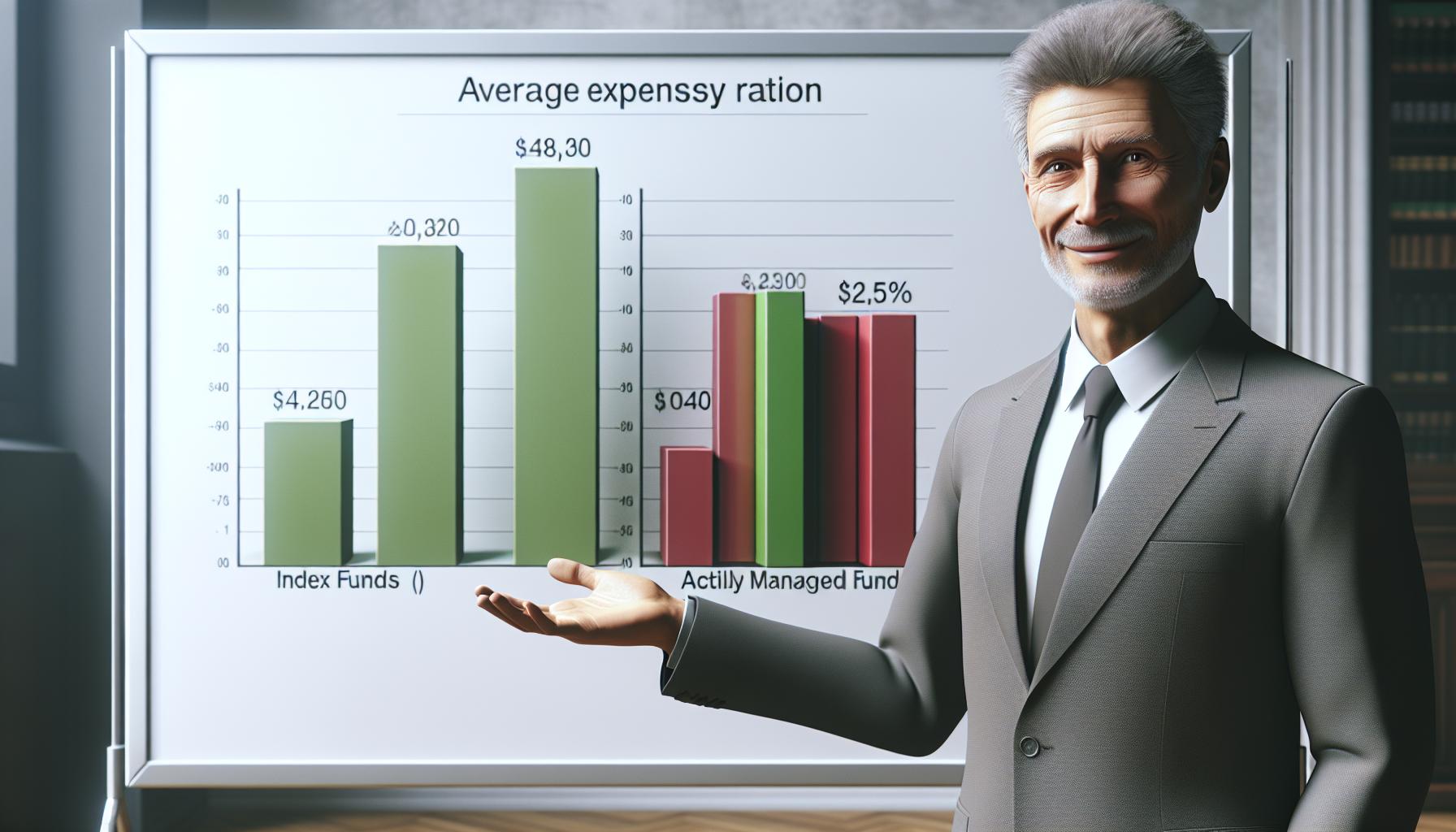

Let’s deep dive into the cost-effectiveness. Index funds are notably less expensive than their actively managed counterparts. Instead of paying premiums for fund managers to frequently trade, your money remains largely untouched, keeping overall costs low. This difference in fees, while seemingly small, can significantly impact your portfolio’s growth over time. The following table illustrates the cost difference between index funds and actively managed funds:

| Fund Type | Average Expense Ratio |

|---|---|

| Index Funds | 0.09% |

| Actively Managed Funds | 0.74% |

The simplicity of index funds shouldn’t be understated. No need to research companies or try to time the market. Simply choose an index fund, put your money in, and let the entire market’s performance dictate your returns. This is why they are often deemed a ‘set it and forget it’ investment.

While diversifying is key to managing risk, it’s equally important to remember index funds are not without risks of their own. Like any market-attached investment, they can and do experience downturns. They can underperform compared to certain sectors at times. This isn’t necessarily a downfall, rather a reminder that all investments come with some measure of risk. The main takeaway here is that index funds offer a simple and cost-effective way to mitigate some of these risks with diversification.

Buffett’s resounding endorsement of index funds is more than just a suggestion; it’s a proven strategy rooted in simplicity, cost-effectiveness, and diversification. For many, it’s worth considering this approach to investment for a steady, long-term journey into the world of finance.

The Power of Owning Hundreds of Companies

Remember, Warren Buffett’s endorsement of index funds isn’t just about the cost-effectiveness or the simplicity. It’s also about the incredible diversity they offer. Investing in an index fund is quite literally like investing in hundreds, sometimes thousands, of companies at once. That’s right, when you buy an index fund, you’re effectively becoming a part owner of all the companies that the fund tracks.

An example I like to give is the S&P 500 index fund. It’s designed to mirror the performance of the Standard & Poor’s 500 index. This, as the name suggests, consists of 500 of the largest companies traded on public markets in the U.S. By putting your dollars in the S&P 500 index fund, you’re spreading your money across all those businesses, in essence acquiring tiny pieces of each.

Let’s consider some numbers. If we assume that you invest $1000 in an S&P 500 index fund, your investment will be spread across 500 companies. If we consider the S&P 500 consists of 505 constituents due to some companies having multiple classes of shares, a simple calculation would look like this:

| Investment Amount ($) | Number of Companies | Amount Invested per Company ($) |

|---|---|---|

| 1,000 | 500 | 2 |

This calculation highlights how wonderful it truly is: your investment risk is spread thin across various sectors and companies. You don’t have to worry about any single investment going wrong and wiping out your savings. Diversity is hence not just an investment strategy; it’s a safety net.

Warren Buffett’s Endorsement of Index Funds

When it comes to investing, this sage of Omaha knows a thing or two. For instance, Warren Buffett endorses index funds as a practical approach to diversify an investment portfolio.

So, you might wonder – why exactly does Buffett champion these instruments? Well, it’s primarily because index funds offer a simple and cost-effective way to achieve broad market exposure. Essentially, they allow you to become a part-owner in a vast array of companies, helping you to spread your investment risk. Cool, right?

Also, we must talk about fees. If you’ve ever tried your hand at picking your own stocks or have hired someone else to do it, you’ll know that it can get pricey. On average, actively managed funds tend to charge a much higher fee than index funds. This means more of your hard-earned cash is spent on fees and less of it is left to grow. Ouch.

It’s important to remember that index funds are not entirely risk-free. That being said, their ease of use, along with their potential for diversification and lower costs does make them rather appealing. It’s a sentiment Buffett himself shares.

Let’s dive in a little deeper into why Buffett, a seasoned player in the finance game, stands firm in his approval of these financial tools. His endorsement is, after all, based on solid reasons backed by decades of market experience. So buckle up, folks, as we really start to unpack Buffett’s association with index funds. Yes, there’s more to this story, so stay tuned as we continue to delve deeper.

Putting Money Where the Mouth is: Buffett’s Bet

In further highlighting the trust Warren Buffet has in index funds, it’s essential to circle back to an infamous bet he made back in 2007. This wager, widely known in investment circles, was a unique demonstration of Buffett’s unwavering faith in low-cost index funds. His belief was, and still is, that these funds consistently perform better than hedge funds, especially over long periods.

The bet was straightforward: he challenged hedge fund managers to pick a selection of funds that could outperform an S&P 500 index fund over a decade. Protege Partners accepted the challenge, selecting five funds of funds to go head-to-head with Buffett’s chosen index fund.

Fast-forward ten years to 2017, the results were crystal clear and resonated with what Buffett had been saying for years.

| Fund Type | Average Annual Compound Return 2008-2017 |

|---|---|

| Buffett’s Pick (Index fund) | 8.5% |

| Protege’s Pick (Hedge funds) | 3.0% |

Buffett’s prediction held true even during the extreme volatility that spanned the decade – the financial crisis of 2008, its aftermath, and periods of significant market gains. Therefore, this bet was much more than a bravado demonstration or simple dare. It served as an enlightening real-world experiment that gave undeniable credibility to the might of index funds.

Segmenting the decade from the bet gives us a clear view of the power of index funds. This is especially true when we map the trajectories of both the index fund and the hedge fund picks. The sheer resilience, steadfastness, and, most importantly, the overall return rate of Buffett’s chosen S&P 500 index fund highlighted the undeniable power of index funds.

In the nine years that followed the financial crisis starting in 2009, the S&P 500 index fund had a compound annual growth rate (CAGR) of nearly 15.8%. By stark contrast, Protege’s picks clocked a CAGR of just 5.5%.

Conclusion

So, there’s no denying that Warren Buffett’s endorsement of index funds is worth noting. Their simplicity, cost-effectiveness, and potential for diversification make them a compelling choice for many investors. While they’re not risk-free, they’ve proven resilient in the face of market fluctuations. Buffett’s 2007 bet is a testament to this resilience, showcasing the impressive performance of an S&P 500 index fund against high-profile hedge funds. It’s clear that index funds can play a pivotal role in a well-rounded investment strategy. As always, I recommend doing your own research and considering your financial goals before making any investment decisions. But it’s safe to say, index funds are a Buffett-approved option worth considering.

What are index funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to follow certain preset rules so that the fund can track a specified basket of underlying investments. They are known for their broad market exposure, low costs, and lower risk compared to individual stocks.

Why does Warren Buffett endorse index funds?

Warren Buffett, one of the most successful investors, endorses index funds because of their simplicity, cost-effectiveness, and their ability to offer broad market exposure. He sees them as a smart way to diversify an investment portfolio and mitigate risk.

How did Warren Buffett’s 2007 bet demonstrate the power of index funds?

In 2007, Warren Buffett bet that an S&P 500 index fund would outperform a selection of hedge funds over a decade. The results showed that the index fund he picked consistently outperformed the hedge funds. This bet served as a powerful demonstration of the resilience and potential return rate of index funds.

Are there risks associated with investing in index funds?

While index funds offer many advantages, they are not without risks. Like any investment, index funds can lose value if the market declines. However, their simplicity and cost-effectiveness often make them a preferred choice for many investors.

Why are index funds cost-effective compared to actively managed funds?

Index funds typically have lower costs than actively managed funds because they simply track an index rather than requiring active management. Lower fees can have a significant positive impact on long-term investment returns.