Inside the Architecture & Evolution of Stock Exchange Buildings: Balancing Tradition Over Technology

Ever walked past a grand edifice and wondered what’s going on inside? That’s often the case with the stock exchange building. It’s not just an architectural marvel, but a bustling hub where fortunes are made and lost in seconds.

The stock exchange building, often located at the heart of a city’s financial district, is a testament to the importance of capital markets in our economy. It’s where traders, brokers, and financial wizards converge to shape the economic future.

Intrigued? You should be. Because the stock exchange building is more than just a place. It’s a symbol of financial power and economic progress. So let’s delve deeper and uncover the fascinating world that lies within these walls.

History of Stock Exchange Buildings

Stepping back in time, we see how the design and function of stock exchange buildings have evolved. The idea of these buildings began in the 17th century during the creation of the Amsterdam Stock Exchange, recognised as the world’s first stock exchange. From their inception, these landmarks were more than simple structures; they were symbols of economic power.

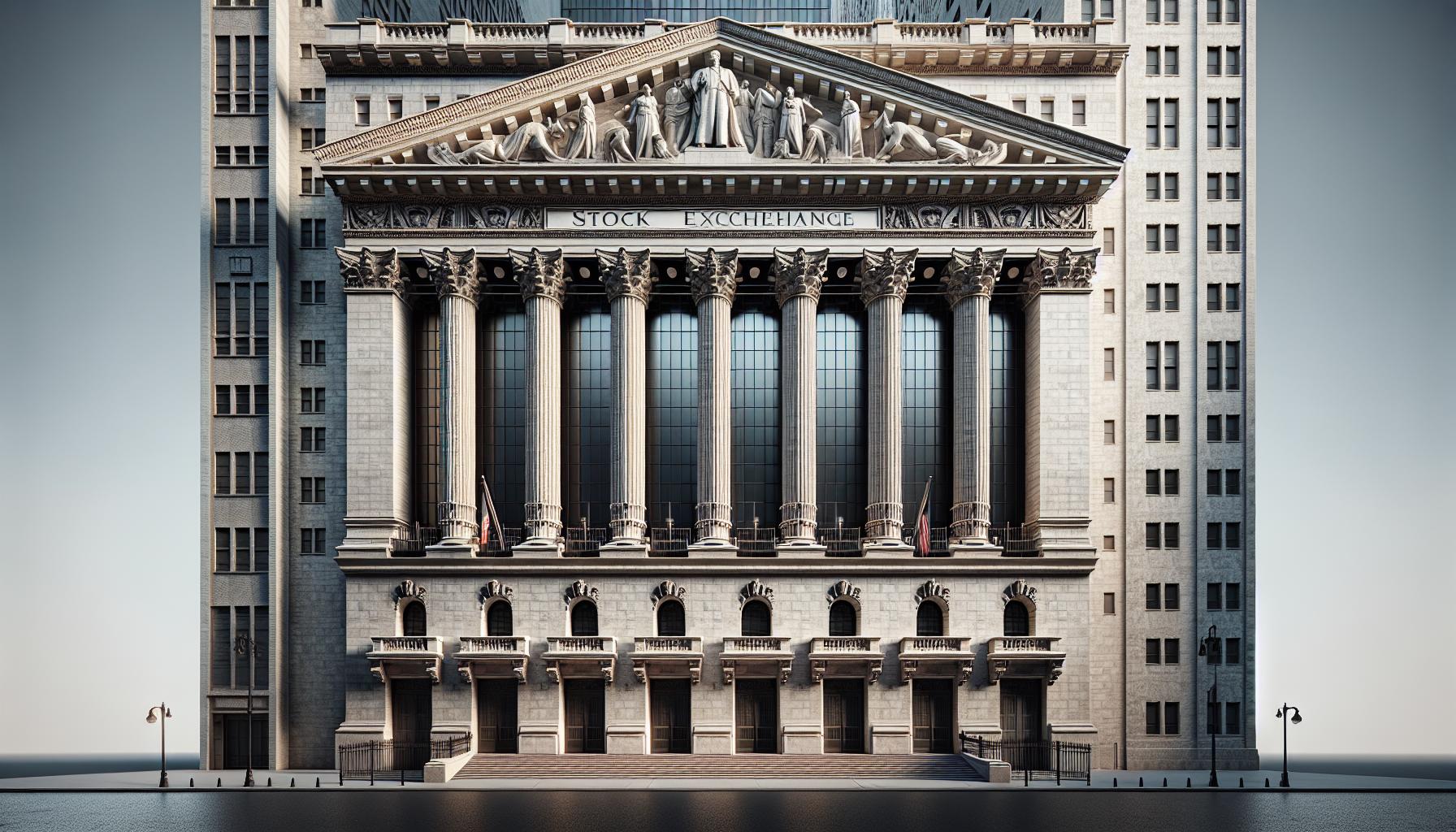

Stock exchange buildings were initially built to house securities trading and became pivotal centers for economic activity. They were the locations where investors met brokers, where heated discussions on commerce took place, and where companies received capital to expand their business operations. For example, the historic New York Stock Exchange building, established in 1817, still stands tall on Wall Street in Manhattan. It’s a testament to its historical significance and impact on the global economy.

As the world moved through the industrial revolution in the 18th and 19th centuries, stock markets became even more critical. There was a rush to build more grandiose and architecturally impressive stock exchange buildings. In London, the construction of the London Stock Exchange building in 1801 was an event of high social status. These buildings showcased the growing power and reach of capitalist systems.

Stock exchanges world over mirrored the advancements in technology and changes in market practices. For instance, in the 20th century, Tokyo constructed a modern structure that housed the Tokyo Stock Exchange – one of the most technologically advanced stock exchanges of its time.

The paradigm shift to digital platforms in more recent years has changed the physical necessity of these buildings. Yet, the historic stock exchange buildings stand tall as landmarks. They narrate tales of economic shifts, technological advancements, and architectural brilliance.

One thing’s for certain: these buildings are far from mere physical structures. They’ve stood as the economic and financial powerhouses of the world, framing the world’s economic history for centuries. As we move into the future, their role continues to evolve and adapt to the changing face of global economics.

Architecture and Design of Stock Exchange Buildings

When we delve into the architectural aspect of stock exchange buildings, there’s more than what meets the eye. Not just peripheral structures, these buildings embody the ethos of global finance and economic power. Their design, from the intricate facades to the expansive trading floors, reflects the dynamism and fluidity of financial markets.

Ever wondered why most stock exchange buildings are imposingly grand? It’s not merely aesthetic taste; it’s about the message they send. Grandeur and majesty are deliberately incorporated into their design to project economic strength and stability. That’s why we find iconic buildings like the New York Stock Exchange, an emblematic structure symbolizing the power of capital.

Now let’s take an inside tour. The heart of these buildings, the trading floors, are specifically designed for functionality. Earlier, necessity dictated their form – bustling spaces filled with traders shouting and signaling to each other. Rapidly changing LEDs, digital scoreboards recording real-time data, and clusters of computer terminals are all vital elements that fit together, creating an environment designed for optimal speed and efficiency.

But it’s not just about grand buildings, and fast-paced trading floors. Sustainability has also taken the front seat in the design of new exchange buildings. Architects are now incorporating green technologies into these economic powerhouses, setting an example for corporate responsibility towards our environment. For instance, the Shanghai Stock Exchange Building is not only a symbol of China’s economic might but also a model for sustainable design.

The architecture and design of stock exchange buildings, hence, is a blend of splendor, functionality, and sustainability. Echoing the vigor of the market, these spaces continue to evolve, marrying tradition with modernity, symbolizing the unceasingly advancing wheels of global finance.

Location and Significance of Stock Exchange Buildings

Continuing our exploration of stock exchange buildings, it’s pivotal to understand the importance of their location, and the significance they hold.

The chosen sites for these financial powerhouses aren’t arbitrary. They are often located in the bustling heart of major cities worldwide, such as Wall Street in New York, and the City of London in the UK.

These iconic areas are strong symbols of economic centers, where monumental transactions take place daily, influencing the global economy. This strategic placement of the stock exchanges enhances their accessibility and visibility, emphasizing their roles as economic powerhouses.

Let’s delve deeper into why specific locales are chosen:

- Networking and Liquidity: Close proximity to financial firms, banks, and brokers boosts networking possibilities. High footfall of finance professionals around the exchange builds liquidity, which drives the stock market.

- Image and Prestige: Stock exchanges are placed in high-profile areas to uphold their prestigious image. The prestige of the location also mirrors the stature of the financial markets, creating an enviable association.

- Infrastructure and Accessibility: Accessibility is another factor. These buildings must be within reach of essential local infrastructure—think transport and amenities.

With the advance of electronic trading systems, you might think the physical location of stock exchanges is dwindling in relevance. However, the symbolic weight carried by these buildings is steadfast. They remain vital landmarks, epitomizing economic power and influence, perpetuating the significance of the financial markets they represent.

As stock exchanges evolve in design, construction, and sustainability traits, they also evolve in their significance. No longer just a place for trading stocks, they’re an embodiment of socio-economic power, technological advancements, and environmental responsibility.

Moving forward, we’ll be exploring how virtual stock exchanges are disrupting the traditional notion of a stock exchange building, and how they’re influencing the future of global finance.

Functions and Operations in Stock Exchange Buildings

When I step into a stock exchange building, it’s almost like entering a different world. This isn’t your ordinary nine-to-five office environment. It’s a vibrant, exciting, and fast-paced place where every minute matters, money and information exchange hands at lightning speed, and key financial decisions are made.

The Trading Floor: Heartbeat of the Stock Exchange

At the heart of the stock exchange building, you’ll find the trading floor. Once filled with the hustle and bustle of traders shouting orders and gesticulating wildly, modern trading floors also accommodate high-speed electronic trading systems, alongside traditional open outcry trading. Here, stocks, bonds, options and other financial instruments are bought and sold by traders who represent investors.

Human and Digital Interactions

Interestingly, despite the prevalence of electronic trading, human interaction remains vital. When complex decisions or disputes arise, it’s the experienced traders and officials on the trading floor who resolve them.

It’s important to note that the trading day doesn’t end with the closing bell. After trading hours, the clearing and settlement departments spring into action, verifying the ownership changes of each trade and making sure the correct amounts get transferred between accounts.

The Evolving Function of Stock Exchange Buildings

Yet, stock exchange buildings are not static entities trapped in time. They’re constantly evolving, integrating new technologies, and adapting to the ever-changing financial landscape.

For instance, some stock exchange buildings now offer data centers and co-location services for trading firms, allowing them to place their servers inside the exchange’s own data center, providing them with the fastest possible access to market data.

So, while the grandeur of stock exchange buildings adds to their appeal, it’s really what happens inside these buildings that’s truly fascinating.

Technologies and Innovations in Stock Exchange Buildings

As the financial landscape continues to transform, stock exchange buildings are not staying behind. They’re powering up with the latest technologies and innovations, emerging as modern hubs where tradition meets innovation. These buildings aren’t just architectural statements anymore; they’re rapidly evolving, burgeoning with state-of-the-art tech upgrades and innovative features that go far beyond their original purpose.

Navigating the Tech Advancements

From digital trading systems to powerful data centers, the technological infrastructure in stock exchange buildings has taken a huge leap. Electronic trading systems have made it possible for transactions to occur at an unimaginably swift pace. Meanwhile, data centers are becoming the backbone of these buildings, making them not just trading venues but also data hubs.

Consider the New York Stock Exchange; their data center in Mahwah, New Jersey, is a technological landmark. Operational since 2010, it is considered one of the most advanced data centers worldwide. It not only caters to NYSE’s data needs but also offers co-location services for trading firms. This denotes the role of financial institutions as key technology players.

Blockchain: The Future of Stock Exchanges?

The rise of blockchain technology is another exciting frontier for stock exchanges globally. Blockchain has been adopted by several exchanges, like the Australian Securities Exchange, which eyes replacing its current clearing system. This technology brings the potential to bolster efficiency, transparency, and security in trading practices -a triple win for all involved.

Despite the obvious digital transformation, anthropological factors remain strong, as trading floors continue to resonate as the heart of action. Amidst the ddigitaliplomacy, human interaction holds a special status, standing out as a crucial element in managing disputes or making complex decisions.

Indeed, stock exchange buildings remain at the forefront, championing the evolving dance between cutting-edge technology and deep-rooted tradition. These iconic infrastructures are proving themselves to be more than just buildings; they’re dynamic, adapting organisms.

Conclusion

Stock exchange buildings truly are architectural marvels that embody economic power. Their strategic placement in world-renowned cities underscores their significance and influence. But they’re more than just buildings. They’re hubs where technology and tradition intersect, where the pulse of the financial world beats strongest. Despite the rise of digital trading and the potential of blockchain, the human element remains vital. From the trading floor to the resolution of complex issues, human interaction is irreplaceable. As we move forward, these buildings continue to evolve, integrating new technologies while preserving the essence of traditional trading. They’ve become adaptable organisms, offering services like data centers and co-location facilities. Stock exchange buildings aren’t just surviving the digital age, they’re thriving and leading the way.

Frequently Asked Questions

Why are stock exchange buildings strategically located in major cities?

Stock exchange buildings are located in major cities such as New York and London to enhance accessibility, visibility, and networking possibilities. This strategic location also upholds the prestigious image of stock exchanges and mirrors the stature of the financial markets.

Do electronic trading systems diminish the significance of physical locations for stock exchanges?

Despite the prominence of electronic trading systems, the physical locations of stock exchanges remain significant. These buildings symbolize economic power and influence.

What are the described functions of a stock exchange building?

Stock exchange buildings house the trading floor where financial instruments are bought and sold. They also facilitate human interaction necessary for resolving complex decisions and disputes.

How are stock exchange buildings evolving with new technologies?

Stock exchange buildings are integrating technologies such as digital trading systems and data centers, and offering co-location services for trading firms. They’re dynamic structures which continuously adapt to the evolving financial landscape.

What role does human interaction play in trading practices despite technological advancements?

Even with advances in technology, human interaction remains crucial in trading practices. Complex decisions and disputes often require the nuanced judgement and decision-making skills inherent in human traders.

What potential does blockchain technology hold for stock exchange operations?

The article suggests that blockchain technology holds potential to revolutionize stock exchange operations. However, the specifics of this potential revolution were not detailed in the article.